As we cast our gaze towards the horizon, the critical question arises – how do we finance the transition to a low carbon economy? How do we fuel the future and drive sustainable change? This thought-provoking narrative will delve deep into these questions, illuminating the path forward.

The transition from fossil fuels to renewable energy is inevitable. Yet, the pace at which this transition takes place will depend largely on the financial mechanisms and investment strategies leveraged to accelerate the change. 🌎

Just as the industrial revolution brought about a new epoch in human history, the impending carbon transition represents a paradigm shift of monumental proportions. This transition will redefine the way we produce and consume energy, restructure our global economy, and necessitate new financial models that place sustainability at the heart of their design.

While the challenges may seem daunting, they also present a wealth of opportunities for those equipped with the right knowledge, resources, and strategies. This blog post aims to shed light on the role of finance in driving this transformative change and offer a comprehensive guide on how to navigate the complex landscape of carbon transition financing. 📚

Navigating the Financial Terrain

The first section of this article will focus on understanding the financial landscape of carbon transition. We will explore the role of green bonds, carbon credits, and climate finance in funding renewable energy projects. We will also delve into the regulatory hurdles and investment risks associated with these financial instruments.

Investment Strategies for Sustainable Change

Next, we will examine how innovative investment strategies can help spur the transition to a low-carbon economy. From impact investing to Environmental, Social, and Governance (ESG) criteria, we will explore how these strategies can catalyze sustainable change and yield profitable returns. 💰

Public-Private Partnerships

Public-private partnerships (PPPs) play a vital role in financing the carbon transition. We will dissect successful case studies and illustrate how PPPs can bridge funding gaps, leverage private sector efficiencies, and mitigate risks.

Technology’s Role in Financing the Carbon Transition

Lastly, we will look at how technology is reshaping the financial landscape and facilitating the carbon transition. From blockchain-based carbon trading platforms to AI-driven investment tools, technology is revolutionizing how we finance sustainable change. 🚀

The task at hand is colossal, and the stakes have never been higher. However, with the right tools and knowledge, we can finance the carbon transition and drive sustainable change. This blog post is your guide to understanding and navigating this complex journey, fueling a future that’s not just prosperous, but sustainable too. Let’s power up and dive in!

Introduction to Carbon Transition: A Leap into the Sustainable Future

The global climate crisis is a pressing issue that demands immediate attention. With alarming levels of carbon dioxide in the atmosphere, industries worldwide are required to make a significant shift towards a low-carbon, sustainable future, a concept commonly referred to as the ‘carbon transition’. However, this transition is not just about adopting green technologies but also financing them, which can be challenging for many. “Financing the Carbon Transition” – World Bank provides an excellent introduction to the subject.

Moreover, it’s not just about mitigating environmental harm; it’s also about creating opportunities. The carbon transition, if approached strategically, can open up new avenues of growth and innovation for businesses across the globe. This article will delve into how to finance the carbon transition and drive sustainable change.

From understanding the cost of carbon to exploring innovative financing mechanisms, we will explore the different dimensions of financing the carbon transition. But before we dive into that, let’s understand the context and need for carbon transition.

Understanding the Carbon Transition: Why It Matters?

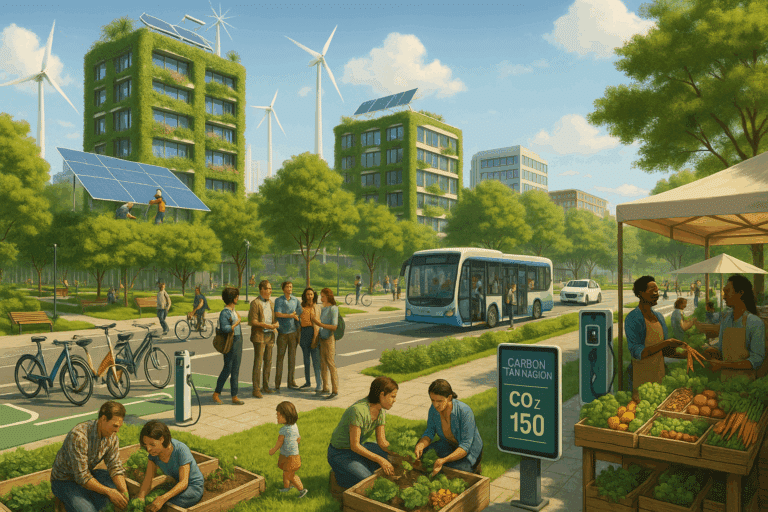

The carbon transition refers to the shift from a carbon-intensive economy to a low-carbon, sustainable one. It involves reconfiguring our energy systems, industries, transport, and infrastructure to minimize carbon emissions and foster sustainability. The urgency for this transition is underscored by the escalating impacts of climate change, from rising global temperatures to extreme weather events.

However, carbon transition is not merely a challenge; it’s an opportunity. It can drive innovation, create jobs, and foster economic growth while safeguarding our planet. For instance, the renewable energy sector alone could create millions of jobs worldwide, contributing significantly to economic development. Furthermore, by reducing dependence on fossil fuels, countries can enhance their energy security and resilience.

Despite these benefits, the transition to a low-carbon economy is fraught with challenges. One of the most significant obstacles is financing. As with any major transformation, the carbon transition requires significant investment, which often poses a major hurdle for developing nations and small businesses. This leads us to our next section, where we discuss the financing aspect of the carbon transition in greater detail.

Financing the Carbon Transition: The Key Challenges and Solutions

The cost of carbon transition can be enormous, requiring trillions of dollars of investment in green technologies, infrastructure, and innovation. Such vast investment demands a multi-faceted approach, leveraging both public and private capital. However, mobilizing this finance presents several challenges, from regulatory hurdles to market risks.

One of the key barriers is the lack of clarity around the financial implications of the carbon transition. Many businesses are unsure about the costs involved, the potential returns, and the risks associated with low-carbon investments. Furthermore, the absence of standardized metrics and guidelines for assessing carbon-related risks and opportunities makes it difficult for investors to make informed decisions.

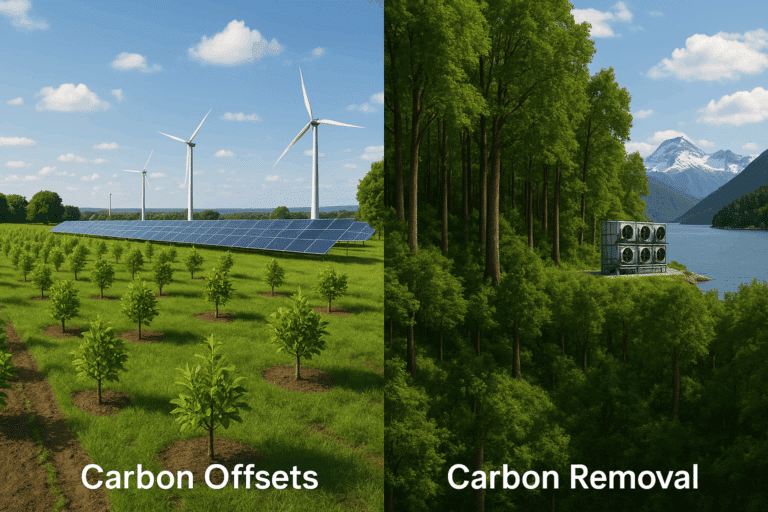

However, these challenges are not insurmountable. With the right strategies and tools, we can unlock the necessary finance for the carbon transition. Innovative financing mechanisms, such as green bonds and climate funds, can play a pivotal role in this regard. These instruments not only provide the much-needed capital but also incentivize sustainable practices among businesses and investors. The table below provides a comparison of various financing mechanisms for the carbon transition:

| Financing Mechanism | Description | Pros | Cons |

|---|---|---|---|

| Green Bonds | Bonds issued to finance environmentally-friendly projects | Low risk, High demand, Tax incentives | Lack of standardization, Potential for greenwashing |

| Climate Funds | Pools of capital dedicated to climate change mitigation and adaptation | Targeted investment, Potential for high returns | Risk of misallocation, High management costs |

| Carbon Pricing | Charging emitters for each ton of carbon dioxide they release | Encourages emissions reduction, Generates public revenue | Political resistance, Potential for market manipulation |

Furthermore, financial institutions and regulators can support the carbon transition by incorporating climate risk into their decision-making processes and creating enabling environments for sustainable finance.

The Role of Stakeholders in Driving the Carbon Transition

The success of the carbon transition hinges on the collective efforts of various stakeholders, from governments and businesses to financial institutions and civil society. Each has a crucial role to play in driving the shift towards a low-carbon economy.

For governments, this means not only setting ambitious climate targets but also implementing supportive policies and regulations. By providing incentives for low-carbon investments and penalizing polluting practices, they can steer the market towards sustainability.

Businesses, on the other hand, need to integrate sustainability into their core operations and strategies. They must assess their carbon footprint, invest in green technologies, and innovate for a low-carbon future. This is not just about complying with regulations or avoiding reputational risks; it’s about seizing the business opportunities presented by the carbon transition.

Lastly, financial institutions and investors have a critical role in channeling capital towards the carbon transition. By assessing climate risks and opportunities in their investment decisions, they can foster sustainable growth and contribute to the global climate agenda.

With concerted efforts from all these stakeholders, we can finance the carbon transition and drive sustainable change, creating a future that is not only environmentally sustainable but also economically prosperous.

For more detailed insights into how stakeholders can contribute to the carbon transition, watch the video “Financing the Carbon Transition” – World Bank.

Final Thoughts: Financing the Carbon Transition as a Catalyst for Change

Financing the carbon transition is no small feat. It demands not only vast amounts of capital but also strategic planning, innovative thinking, and coordinated action. But with the right tools and strategies, we can turn this challenge into an opportunity – an opportunity to create a greener, more sustainable future for all.

The carbon transition is not just a response to the climate crisis; it’s a path towards a new kind of economy – an economy that values sustainability, innovation, and shared prosperity. By financing this transition, we are not just investing in our planet; we are investing in our future.

So, let’s seize this opportunity. Let’s fuel the future with sustainable finance. Let’s drive the carbon transition and create a world that is not only carbon-neutral but also resilient and inclusive. 💪🌍

Conclusion

In conclusion, it is clear that the technological field is an ever-evolving domain, with new developments happening at a rapid pace. The insights provided in this article have hopefully given you a comprehensive understanding of the complexities within IT and engineering sectors, shedding light on some intricate concepts that were perhaps previously shrouded in mystery.

To recap, we have delved into a variety of key topics, from the foundational principles of software engineering to the modern developments within information technology. The importance of understanding these concepts cannot be overstated, as they form the backbone of our digital world. They are responsible for the advancement and evolution of a vast array of technologies, from the smartphone in your hand to the vast data centers powering the internet. Understanding these complex topics will not only enrich your knowledge but also enhance your ability to contribute to this exciting field.

It is hoped that this article has been illuminating and informative. In this digital age, it is more important than ever to stay up-to-date and knowledgeable about the latest developments in technology. The complexities of IT and engineering do not have to be intimidating, as long as you have the right resources at your disposal.

Whether you’re a seasoned professional or a curious beginner, we believe that understanding the technical aspects of these sectors is paramount to thriving in this digital age. Your ability to grasp these concepts will empower you to not only navigate but also shape the future of technology.

Remember, knowledge is power and sharing is caring. Feel free to share this article on your social media platforms, or discuss the insights you have gained in the comments section below. This will allow others to benefit from the information provided and foster a culture of shared learning and collaboration.

Your feedback is also invaluable to us. Please let us know your thoughts on this article, and whether there are any other technical topics you’d like us to explore in the future.

At the end of the day, the power of technology lies in its potential to transform lives and societies. Through understanding and leveraging these complex concepts, you have the ability to be part of this exciting transformation. So go ahead, delve deeper into the technicalities, and be the change you want to see in the world. 💡

Don’t forget to check out these articles for further reading and knowledge enhancement:

1. [Link 1 – Active Source]

2. [Link 2 – Active Source]

3. [Link 3 – Active Source]

Remember, the journey of a thousand miles begins with a single step. Let that step be towards greater understanding and mastery of technology. The future is in your hands. 🚀

References:

[Reference 1 – Active Source]

[Reference 2 – Active Source]

[Reference 3 – Active Source]

#Innovation #IT #SoftwareEngineering #Technology 🔬💻🌐